Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite

Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite

UCC has paid huge sums to a criminal professor

This story is not for republication. I bear responsibility for the things I write. I have read the guidelines and understand that I must not write anything untrue, and I won't.

This is a public interest story about a complete failure of governance and management at UCC.

Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent

Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent

Socratic Dialog Between ChatGPT-5 and Mind Agent Reveals Fatal and Deliberate 'Design by Construction' Flaw

This design flaw in ChatGPT-5's default epistemic mode subverts what the much touted ChatGPT-5 can do... so long as the flaw is not tickled, any usage should be fine---The epistemological question is: how would anyone in the public, includes you reading this (since no one is all knowing), in an unfamiliar domain know whether or not the flaw has been tickled when seeking information or understanding of a domain without prior knowledge of that domain???!

This analysis is a pretty unique and significant contribution to the space of empirical evaluation of LLMs that exist in AI public world... at least thus far, as far as I am aware! For what it's worth--as if anyone in the ChatGPT universe cares as they pile up on using the "PhD level scholar in your pocket".

According to GPT-5, and according to my tests, this flaw exists in all LLMs... What is revealing is the deduction GPT-5 made: Why ?design choice? starts looking like ?deliberate flaw?.

People are paying $200 a month to not just ChatGPT, but all major LLMs have similar Pro pricing! I bet they, like the normal user of free ChatGPT, stay in LLM's default mode where the flaw manifests itself. As it did in this evaluation.

AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent

AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent

Evaluating Semantic Reasoning Capability of AI Chatbot on Ontologically Deep Abstract (bias neutral) Thought

I have been evaluating AI Chatbot agents for their epistemic limits over the past two months, and have tested all major AI Agents, ChatGPT, Grok, Claude, Perplexity, and DeepSeek, for their epistemic limits and their negative impact as information gate-keepers.... Today I decided to test for how AI could be the boon for humanity in other positive areas, such as in completely abstract realms, such as metaphysical thought. Meaning, I wanted to test the LLMs for Positives beyond what most researchers benchmark these for, or have expressed in the approx. 2500 Turing tests in Humanity?s Last Exam.. And I chose as my first candidate, Google DeepMind's Gemini as I had not evaluated it before on anything.

Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy

Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy

We have all known it for over 2 years that it is a genocide in Gaza

Israeli human rights group B'Tselem has finally admitted what everyone else outside Israel has known for two years is that the Israeli state is carrying out a genocide in Gaza

Western governments like the USA are complicit in it as they have been supplying the huge bombs and missiles used by Israel and dropped on innocent civilians in Gaza. One phone call from the USA regime could have ended it at any point. However many other countries are complicity with their tacit approval and neighboring Arab countries have been pretty spinless too in their support

With the release of this report titled: Our Genocide -there is a good chance this will make it okay for more people within Israel itself to speak out and do something about it despite the fact that many there are actually in support of the Gaza

China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy

China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy

This story is unverified but it is very instructive of what will happen when cash is removed

THIS STORY IS UNVERIFIED BUT PLEASE WATCH THE VIDEO OR READ THE TRANSCRIPT AS IT GIVES AN VERY GOOD IDEA OF WHAT A CASHLESS SOCIETY WILL LOOK LIKE. And it ain't pretty

A single video report has come out of China claiming China's biggest cities are now cashless, not by choice, but by force. The report goes on to claim ATMs have gone dark, vaults are being emptied. And overnight (July 20 into 21), the digital yuan is the only currency allowed.

The Saker >>

Interested in maladministration. Estd. 2005

RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony

RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony

Joe Duffy is dishonest and untrustworthy Anthony

Joe Duffy is dishonest and untrustworthy Anthony

Robert Watt complaint: Time for decision by SIPO Anthony

Robert Watt complaint: Time for decision by SIPO Anthony

RTE in breach of its own editorial principles Anthony

RTE in breach of its own editorial principles Anthony

Waiting for SIPO Anthony

Waiting for SIPO Anthony

Public Inquiry >>

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc

Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc

Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc

Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc

Human Rights in Ireland >>

Met Hired Child Rapist in Diversity Drive Fri Jan 09, 2026 09:00 | Richard Eldred

Met Hired Child Rapist in Diversity Drive Fri Jan 09, 2026 09:00 | Richard Eldred

A child rapist was hired by the Met in a reckless diversity push that let more than 100 dangerous officers slip through without proper checks.

The post Met Hired Child Rapist in Diversity Drive appeared first on The Daily Sceptic.

Trump Dumps IPCC and UN Framework Convention on Climate Change Fri Jan 09, 2026 07:00 | Ben Pile

Trump Dumps IPCC and UN Framework Convention on Climate Change Fri Jan 09, 2026 07:00 | Ben Pile

Donald Trump has dumped the IPCC and UN Framework Convention on Climate Change, striking at the heart of the international climate apparatus. This will inflict serious trauma on the British Establishment, says Ben Pile.

The post Trump Dumps IPCC and UN Framework Convention on Climate Change appeared first on The Daily Sceptic.

News Round-Up Fri Jan 09, 2026 00:26 | Richard Eldred

News Round-Up Fri Jan 09, 2026 00:26 | Richard Eldred

A summary of the most interesting stories in the past 24 hours that challenge the prevailing orthodoxy about the ?climate emergency?, public health ?crises? and the supposed moral defects of Western civilisation.

The post News Round-Up appeared first on The Daily Sceptic.

Trans ?Woman? ?Threatened to Firebomb Law Firm?, Court Hears Thu Jan 08, 2026 19:00 | Will Jones

Trans ?Woman? ?Threatened to Firebomb Law Firm?, Court Hears Thu Jan 08, 2026 19:00 | Will Jones

A trans 'woman' has been accused of a ?100,000 blackmail plot to firebomb a law firm, a court has heard.

The post Trans ‘Woman’ “Threatened to Firebomb Law Firm”, Court Hears appeared first on The Daily Sceptic.

Hotel Migrants? ?Abusive Behaviour? Forces Restaurant to Close Thu Jan 08, 2026 17:00 | Will Jones

Hotel Migrants? ?Abusive Behaviour? Forces Restaurant to Close Thu Jan 08, 2026 17:00 | Will Jones

The "abusive behaviour" of migrants staying in a local hotel and the "ongoing damage" they are causing has been blamed for the closure of a 20 year-old restaurant.

The post Hotel Migrants’ “Abusive Behaviour” Forces Restaurant to Close appeared first on The Daily Sceptic.

Lockdown Skeptics >>

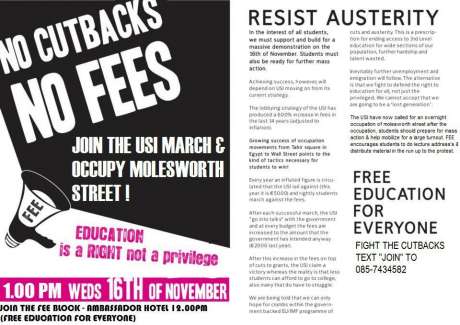

national |

education |

event notice

national |

education |

event notice

Thursday November 10, 2011 10:58

Thursday November 10, 2011 10:58 by FEE - Free education for everyone

by FEE - Free education for everyone

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter

View Comments Titles Only

save preference

Comments (4 of 4)

Jump To Comment: 1 2 3 4Please change block to bloc. Apologies!

If the platform is for free education for all, then I don't think it is one that I will be supporting. Those who can afford to pay to go to third-level education, should have to pay for the privilege. Our Universities have become more and more semi-privatised education production lines. Fees should not have been abolished. We cannot and could never afford to subsidise the wealthy to attend college. Those who can't afford it, should be helped. To say that education should be free to all is hopelessly naive and just serves to maintain the status quo and exclude working-class people form colleges. Going to college is not easy nor should it be, however, there are many who can afford to pay for it. Common sense should prevail.

Currently the poor subsidise the rich attending college.

In practice figures show that free fees and the grant scheme have not significantly helped change the imbalance of people attending college from socioeconomically disadvantaged groups vs the wealthy sectors who continue to benefit from free fees. There are other issues here as well it seems. Maybe to do with social culture, hidden registration costs (stealth fees currently 2k+) and possibly the actual application procedures.

But money is still also an issue. It seems to me that a compromise is in order here.

There should be a base level under which you pay no fees then above that, a graduated scale and a cutoff point whereby the state no longer subsidises you either through fees or grants.

Thereby, helping poorer people to attend, whilst not subsidising the rich. Same principle should apply regarding childrens allowance.

If the 'free fees' initiative should be abolished because the 'poor subsidise the rich', isn't the logical extension that free primary & secondary education should also be abolished on the same basis?

College fees exist. At €2,000, they're the second highest in the EU.

They're not there for equity reasons - as fees have been increased in recent budgets, the maintenance grant has been cut. It's naive to believe that increasing fees will provide additional funding for third level institutions, or student support schemes. They will be (and currently are) used to reduce public funding. Increases in fees have already coincided with reductions to the core block grant.

Unwittingly, those that support fees on equity grounds are supporting the extension of the neoliberal model which fuels inequality - a model which despises public services, and seeks to reduce public funding by shifting the costs burden onto to individual, in order to maintain low taxes on wealth & profits. This is the same underlying process affecting water charges, the health service & other public services. The application of these neoliberal principles to tertiary education is not the answer to improving equality of access. It's this economic model itself which needs to be opposed.

The reason the 'free fees' initiative has had limited success is because the barriers to education don't suddenly arise on the day a student receives their CAO results, they arise through the cumulative effects of inequality in a multitude of areas from the moment they're born. The child of a 'professional' can expect to get about 92 points more Leaving Certificate points than the child of a 'manual worker'. Attempts to address this at third level are always going to have a limited effect.

Educational disadvantage doesn't exist in a bubble - class still matters. It's only by addressing inequality, both inside and outside of education, that equality of access can be genuinely improved.

One of the primary methods for achieving this - within capitalism - is through progressive tax reform. The additional public funding gained through taxation could be used to target educational disadvantage at all levels, through funding areas like pre-school education, special needs assistants, retention initiatives, reducing pupil-teacher-ratios, maintenance grants which reflect the cost of living, and the Back to Education Allowance. Additional public funding, based on taxation of those who can afford it, can be used to reduce inequality in areas outside the education sector.

As for the argument that 'we can't afford it' - most companies either don't pay pay corporation tax, or pay an effective rate of between 4-7%, according tho the head of Trinitys School of Business [1]. Companies like Google uses tax avoidance schemes such as 'double Irish' to only pay €5.6 million in corporation tax on a turnover of €10 billion. [2] Taxes on wealth/capital, like CGT & CAT, also remain low.

The other typical argument is that higher taxes would 'damage competitiveness' . Higher tax economies, such as Sweden & Denmark, outperform Ireland in competitiveness rankings, according to the right-wing World Economic Forum. Part of the reason for this is that they use taxation to invest in areas like education, health, & infrastructure.

Shifting the cost burden onto students is not an economic necessity, it's a policy choice.

[1]http://www.tcd.ie/iiis/documents/discussion/abstracts/I...5.php , and another good article on corporation tax can be found at http://www.progressive-economy.ie/2011/04/125-per-cent-....html

[2]http://www.independent.ie/business/irish/google-paid-on....html

http://www.facebook.com/event.php?eid=174678195957077