Interested in maladministration. Estd. 2005

RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony

Joe Duffy is dishonest and untrustworthy Anthony Joe Duffy is dishonest and untrustworthy Anthony

Robert Watt complaint: Time for decision by SIPO Anthony Robert Watt complaint: Time for decision by SIPO Anthony

RTE in breach of its own editorial principles Anthony RTE in breach of its own editorial principles Anthony

Waiting for SIPO Anthony Waiting for SIPO Anthony Public Inquiry >>

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc Human Rights in Ireland >>

Revealed: Whitty Silenced Covid Ethics Advisers Sat Dec 06, 2025 19:00 | Toby Young Revealed: Whitty Silenced Covid Ethics Advisers Sat Dec 06, 2025 19:00 | Toby Young

Sir Chris Whitty silenced an ethical advisory group set up to advise him about the harmful effects of lockdown when they started telling him what he didn't want to hear.

The post Revealed: Whitty Silenced Covid Ethics Advisers appeared first on The Daily Sceptic.

Activists Attack Crown Jewels With Apple Crumble and Custard Sat Dec 06, 2025 17:00 | Toby Young Activists Attack Crown Jewels With Apple Crumble and Custard Sat Dec 06, 2025 17:00 | Toby Young

A new Marxist protest group calling itself Take Back Power ? consisting of public school-educated toffs called Tarquin and Arabella, no doubt ? have thrown custard at the Crown Jewels to, er, fight poverty.

The post Activists Attack Crown Jewels With Apple Crumble and Custard appeared first on The Daily Sceptic.

Police Arrest Anti-Abortionist at Peaceful Protest Sat Dec 06, 2025 15:00 | Toby Young Police Arrest Anti-Abortionist at Peaceful Protest Sat Dec 06, 2025 15:00 | Toby Young

A 27 year-old Christian has been arrested for protesting peacefully against abortion in Cambridge. The incident comes after the US warned the UK's arrest of abortion protestors put the countries' "shared values" at risk.

The post Police Arrest Anti-Abortionist at Peaceful Protest appeared first on The Daily Sceptic.

Is the Imminent Closure of 50 Universities Really Such a Bad Thing? Sat Dec 06, 2025 13:00 | Duke Maskell Is the Imminent Closure of 50 Universities Really Such a Bad Thing? Sat Dec 06, 2025 13:00 | Duke Maskell

The Guardian reports that 50 universities are at risk of imminent closure. But Duke Maskell wonders if this really is the catastrophe the Guardian thinks it is.

The post Is the Imminent Closure of 50 Universities Really Such a Bad Thing? appeared first on The Daily Sceptic.

Tories Demand Deportation of Antisemitic Foreign Students Sat Dec 06, 2025 11:00 | Toby Young Tories Demand Deportation of Antisemitic Foreign Students Sat Dec 06, 2025 11:00 | Toby Young

Two senior Tory shadow cabinet ministers have written to the Education Secretary urging her to deport anti-Semitic foreign students who harass and intimidate their Jewish peers.

The post Tories Demand Deportation of Antisemitic Foreign Students appeared first on The Daily Sceptic. Lockdown Skeptics >>

Voltaire, international edition

Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en Will intergovernmental institutions withstand the end of the "American Empire"?,... Sat Apr 05, 2025 07:15 | en

Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en Voltaire, International Newsletter N?127 Sat Apr 05, 2025 06:38 | en

Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en Disintegration of Western democracy begins in France Sat Apr 05, 2025 06:00 | en

Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en Voltaire, International Newsletter N?126 Fri Mar 28, 2025 11:39 | en

The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en The International Conference on Combating Anti-Semitism by Amichai Chikli and Na... Fri Mar 28, 2025 11:31 | en Voltaire Network >>

|

Low yields turn off Irish Property Investors

national |

housing |

opinion/analysis national |

housing |

opinion/analysis

Tuesday November 14, 2006 13:22 Tuesday November 14, 2006 13:22 by The Unwelcome Guest - thepropertypin by The Unwelcome Guest - thepropertypin

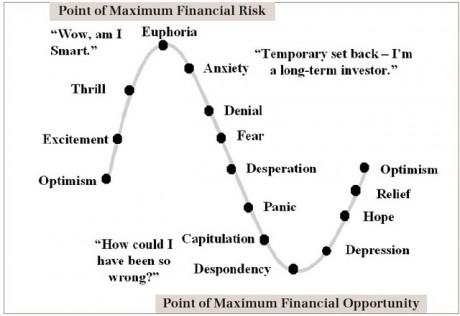

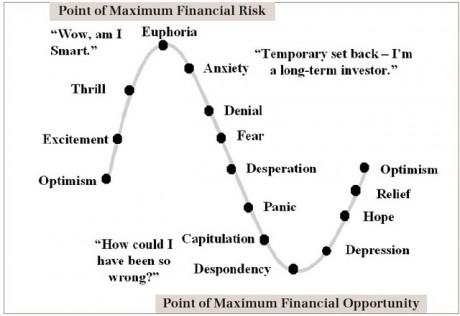

- Market moves from Euphoria to Anxiety

Low Yields turn off Irish Property Investors

November 13, 2006

A new survey shows that the majority of investors in the buy-to-let market do not plan to purchase another property in the next year. The survey was commissioned by EBS and Gunne Residential.

Market Roller Coaster of the Mind Two thirds of those surveyed said they were not getting a better return on their investments as their rental income had not increased in the past year.

Of those planning to buy another property in the next year, only a fifth said they would use their SSIA to fund the deposit, while 57% would borrow against another property.

71% of investors said they were buying property to provide a pension, while 51% said it was to build up a nest egg for their children. Investors continue to quit Dublin, with less than half now owning their investment property in the city, compared with last year.

The Seven Stages Of A Financial Bubble

Stage One – Displacement

Every financial crisis starts with a disturbance. It might be the invention of a new technology, such as the internet. It could be a shift in economic policy. For example, interest rates might be reduced unexpectedly. Whatever it is, the world changes for one sector of the economy. People see the sector differently.

Stage Two – Prices start to increase

Following the displacement, prices in the displaced sector start to rise. Initially, the price increase is barely noticed. Usually, these higher prices reflect some underlying improvement in fundamentals. As the price increases gain momentum, people start to notice.

Stage three – Easy Credit

Increasing prices are not enough for a bubble. Every financial crisis needs rocket fuel and there is only one thing that this rocket burns - cheap credit. Without it, there can be no speculation. Without it, the consequences of the displacement peter out and the sector returns to normal.When a bubble starts, the market is invaded by outsiders. Without cheap credit, the outsiders can’t join in.

Cheap credit is the entrance ticket for outsiders. For example, gas prices have risen sharply in recent years. However, banks aren’t giving out loans so that people can store gas in their garages in the hope that the price will double in three months. The banks, however, are prepared to give loans to people with poor credit to hold condos in the hope that they can be quickly flipped.

The rise in easy credit is also often associated with financial innovation. Often, a new type of financial instrument is developed that miss-prices risk. Indeed, easy credit and financial innovation is a dangerous cocktail. The South-Sea Bubble started life as new-fangled legal innovation called the limited liability joint stock company. In 1929, stock prices were propelled into the stratosphere with the help of margin calls. Housing prices today accelerated as interest-only mortgages emerged as a viable means for financing overpriced real estate purchases.

Stage Four – Over-trading

As the effects of easy credit kicks in, the market starts to overtrade. Overtrading stimulates volumes and shortages emerge. Prices start to accelerate, and easy profits are made. More outsiders are attracted, and prices run out of control. Accelerating prices attract the foolish, greedy and the desperate to enter the market. As a fire needs more fuel, a bubble needs more outsiders.

Stage five – Euphoria

The bubble now enters its most tragic stage. Some wise voices will stand up and say that the bubble can no longer continue. They put together convincing arguments based upon long run fundamentals and sound economic logic. However, these arguments evaporate in the heat of the one over-riding fact – the price is still rising. The wise are shouted down by charlatans, who justify insane prices by the euphoric claim that the world is different and this new world means higher prices.

Of course, the “new world” claim is true; the world is different every day, but that doesn’t mean that prices run out of control. The charlatan wins the day and unjustified optimism takes over. At this point, the charlatans bolster their optimism with the cruelest of all lies; when prices finally reach their new long run level, there will be a “soft landing”. The idea of a gentle deceleration of prices calms the nerves.The outsiders are trapped in knowing denial. They know that prices can’t keep rising forever, but they rarely act on that knowledge. Everything is safe so long as they quit one day before the bubble bursts.Those that did not enter the market are stuck in a terrible dilemma. They can not enter but neither can they stay out. They know that they have missed the beginning of the bubble. They are bombarded daily with stories of easy riches and friends making massive profits. The strong stay out and reconcile themselves to the missed opportunity. The weak enter the fire and are damned.

Stage Six - Insider profit taking

Everyone wants to believe in a new brighter future but a bubble takes that desire and turns it upside down. A bubble demands that everyone believes in a brighter future, and so long as this euphoria continues, the bubble is sustained.However, as madness takes hold of the outsiders, the insiders remember the old world. They lose their faith and start to panic. They understand their market, and they know that it has all gone too far. Insiders start to cash out. Typically, the insiders try to sneak away unnoticed, and sometimes they get away with it. Other times, the outsiders see them as they leave. Whether the outsiders see them leave or not, insider profit taking signals the beginning of the end.

Stage seven - Revulsion

Sometimes, panic of the insiders infects the outsiders. Other times, it is the end of cheap credit or some unanticipated piece of news. But whatever may be, euphoria is replaced with revulsion. The building is on fire and everyone starts to run for the door. Outsiders start to sell, but there are no buyers. Panic sets in; prices start to tumble downwards, credit dries up, and losses start to accumulate.

Here is the paradox of all bubbles – everyone knows how the fatal combination of easy credit, overtrading and euphoria will affect prices. Minsky didn’t need to write down a thing about the madness of speculation. America’s investors have a lifetime of experience. Within the space of five years, America moved from the tech stock bubble into the real estate bubble.Today’s housing prices are grossly overvalued. Everyone knows that prices will collapse. It might be tomorrow, or it might be two years from now. One thing, however is certain, the longer it takes for the bubble to burst, the more painful it will be.

With thanks to StoppedClock, Green Bear & Duplex - thepropertypin

|

national |

housing |

opinion/analysis

national |

housing |

opinion/analysis

Tuesday November 14, 2006 13:22

Tuesday November 14, 2006 13:22 by The Unwelcome Guest - thepropertypin

by The Unwelcome Guest - thepropertypin

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter

View Full Comment Text

save preference

Comments (31 of 31)