Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite

Fraud and mismanagement at University College Cork Thu Aug 28, 2025 18:30 | Calli Morganite

UCC has paid huge sums to a criminal professor

This story is not for republication. I bear responsibility for the things I write. I have read the guidelines and understand that I must not write anything untrue, and I won't.

This is a public interest story about a complete failure of governance and management at UCC.

Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent

Deliberate Design Flaw In ChatGPT-5 Sun Aug 17, 2025 08:04 | Mind Agent

Socratic Dialog Between ChatGPT-5 and Mind Agent Reveals Fatal and Deliberate 'Design by Construction' Flaw

This design flaw in ChatGPT-5's default epistemic mode subverts what the much touted ChatGPT-5 can do... so long as the flaw is not tickled, any usage should be fine---The epistemological question is: how would anyone in the public, includes you reading this (since no one is all knowing), in an unfamiliar domain know whether or not the flaw has been tickled when seeking information or understanding of a domain without prior knowledge of that domain???!

This analysis is a pretty unique and significant contribution to the space of empirical evaluation of LLMs that exist in AI public world... at least thus far, as far as I am aware! For what it's worth--as if anyone in the ChatGPT universe cares as they pile up on using the "PhD level scholar in your pocket".

According to GPT-5, and according to my tests, this flaw exists in all LLMs... What is revealing is the deduction GPT-5 made: Why ?design choice? starts looking like ?deliberate flaw?.

People are paying $200 a month to not just ChatGPT, but all major LLMs have similar Pro pricing! I bet they, like the normal user of free ChatGPT, stay in LLM's default mode where the flaw manifests itself. As it did in this evaluation.

AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent

AI Reach: Gemini Reasoning Question of God Sat Aug 02, 2025 20:00 | Mind Agent

Evaluating Semantic Reasoning Capability of AI Chatbot on Ontologically Deep Abstract (bias neutral) Thought

I have been evaluating AI Chatbot agents for their epistemic limits over the past two months, and have tested all major AI Agents, ChatGPT, Grok, Claude, Perplexity, and DeepSeek, for their epistemic limits and their negative impact as information gate-keepers.... Today I decided to test for how AI could be the boon for humanity in other positive areas, such as in completely abstract realms, such as metaphysical thought. Meaning, I wanted to test the LLMs for Positives beyond what most researchers benchmark these for, or have expressed in the approx. 2500 Turing tests in Humanity?s Last Exam.. And I chose as my first candidate, Google DeepMind's Gemini as I had not evaluated it before on anything.

Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy

Israeli Human Rights Group B'Tselem finally Admits It is Genocide releasing Our Genocide report Fri Aug 01, 2025 23:54 | 1 of indy

We have all known it for over 2 years that it is a genocide in Gaza

Israeli human rights group B'Tselem has finally admitted what everyone else outside Israel has known for two years is that the Israeli state is carrying out a genocide in Gaza

Western governments like the USA are complicit in it as they have been supplying the huge bombs and missiles used by Israel and dropped on innocent civilians in Gaza. One phone call from the USA regime could have ended it at any point. However many other countries are complicity with their tacit approval and neighboring Arab countries have been pretty spinless too in their support

With the release of this report titled: Our Genocide -there is a good chance this will make it okay for more people within Israel itself to speak out and do something about it despite the fact that many there are actually in support of the Gaza

China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy

China?s CITY WIDE CASH SEIZURES Begin ? ATMs Frozen, Digital Yuan FORCED Overnight Wed Jul 30, 2025 21:40 | 1 of indy

This story is unverified but it is very instructive of what will happen when cash is removed

THIS STORY IS UNVERIFIED BUT PLEASE WATCH THE VIDEO OR READ THE TRANSCRIPT AS IT GIVES AN VERY GOOD IDEA OF WHAT A CASHLESS SOCIETY WILL LOOK LIKE. And it ain't pretty

A single video report has come out of China claiming China's biggest cities are now cashless, not by choice, but by force. The report goes on to claim ATMs have gone dark, vaults are being emptied. And overnight (July 20 into 21), the digital yuan is the only currency allowed.

The Saker >>

Interested in maladministration. Estd. 2005

RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony

RTEs Sarah McInerney ? Fianna Fail?supporter? Anthony

Joe Duffy is dishonest and untrustworthy Anthony

Joe Duffy is dishonest and untrustworthy Anthony

Robert Watt complaint: Time for decision by SIPO Anthony

Robert Watt complaint: Time for decision by SIPO Anthony

RTE in breach of its own editorial principles Anthony

RTE in breach of its own editorial principles Anthony

Waiting for SIPO Anthony

Waiting for SIPO Anthony

Public Inquiry >>

Indymedia Ireland is a volunteer-run non-commercial open publishing website for local and international news, opinion & analysis, press releases and events. Its main objective is to enable the public to participate in reporting and analysis of the news and other important events and aspects of our daily lives and thereby give a voice to people.

Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc

Trump hosts former head of Syrian Al-Qaeda Al-Jolani to the White House Tue Nov 11, 2025 22:01 | imc

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

Rip The Chicken Tree - 1800s - 2025 Tue Nov 04, 2025 03:40 | Mark

Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc

Study of 1.7 Million Children: Heart Damage Only Found in Covid-Vaxxed Kids Sat Nov 01, 2025 00:44 | imc

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

The Golden Haro Fri Oct 31, 2025 12:39 | Paul Ryan

Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc

Top Scientists Confirm Covid Shots Cause Heart Attacks in Children Sun Oct 05, 2025 21:31 | imc

Human Rights in Ireland >>

Energy Policy Pantomime Sun Dec 28, 2025 17:00 | David Turver

Energy Policy Pantomime Sun Dec 28, 2025 17:00 | David Turver

With heroes, villains and plenty of booing as bills rise and promises fall flat, David Turver gives Net Zero the full Christmas panto treatment.

The post Energy Policy Pantomime appeared first on The Daily Sceptic.

The Constitutional Vandals Are Not Those Scrutinising the Assisted Dying Bill Sun Dec 28, 2025 15:00 | Richard Eldred

The Constitutional Vandals Are Not Those Scrutinising the Assisted Dying Bill Sun Dec 28, 2025 15:00 | Richard Eldred

Rushing the Assisted Dying Bill through the Lords risks cutting corners on a law that lets the state end lives, says Toby in the Telegraph. Taking time to check it properly isn't vandalism ? it's just common sense.

The post The Constitutional Vandals Are Not Those Scrutinising the Assisted Dying Bill appeared first on The Daily Sceptic.

Exams Favour White Students Says Birmingham University?s Business School Sun Dec 28, 2025 13:00 | Sallust

Exams Favour White Students Says Birmingham University?s Business School Sun Dec 28, 2025 13:00 | Sallust

On top of all the other disadvantages non-white people face, passing exams is now being labelled a con thanks to "white privilege", so says a Birmingham University report on "decolonising" its business school.

The post Exams Favour White Students Says Birmingham University?s Business School appeared first on The Daily Sceptic.

Wasted Wind Power Costs Britain Almost ?1.5 Billion in 2025 Sun Dec 28, 2025 11:00 | Richard Eldred

Wasted Wind Power Costs Britain Almost ?1.5 Billion in 2025 Sun Dec 28, 2025 11:00 | Richard Eldred

Nearly ?1.5 billion of wind power has been wasted this year as grid bottlenecks force turbines off, gas on and bills up.

The post Wasted Wind Power Costs Britain Almost ?1.5 Billion in 2025 appeared first on The Daily Sceptic.

Reform Could Strip Pensions From Civil Servants Who Let in Sex Offender Migrants ? and Send Them to ... Sun Dec 28, 2025 09:00 | Toby Young

Reform Could Strip Pensions From Civil Servants Who Let in Sex Offender Migrants ? and Send Them to ... Sun Dec 28, 2025 09:00 | Toby Young

Zia Yousuf, Reform's Head of Policy, says a Reform government will create a new criminal offence of "dishonestly determining an asylum claim", punishable of up to two years in prison.

The post Reform Could Strip Pensions From Civil Servants Who Let in Sex Offender Migrants ? and Send Them to Jail appeared first on The Daily Sceptic.

Lockdown Skeptics >>

international |

anti-capitalism |

feature

international |

anti-capitalism |

feature

Tuesday September 30, 2008 20:54

Tuesday September 30, 2008 20:54 by original by Kieran Allen - SWP

by original by Kieran Allen - SWP

printable version

printable version

Digg this

Digg this del.icio.us

del.icio.us Furl

Furl Reddit

Reddit Technorati

Technorati Facebook

Facebook Gab

Gab Twitter

Twitter

View Comments Titles Only

save preference

Comments (24 of 24)

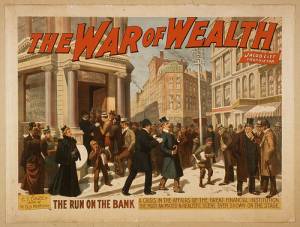

Jump To Comment: 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24"Most people are amazed to witness a new Wall St crash, when the spectacle of the 1929 crash was supposed to have vanished forever."

Not readers of indymedia.ie -here is an article from last january explaining what was happening=

http://www.indymedia.ie/article/85890

It was an easy enough mistake to make in fairness. You have approached this crises "the subprime bother" and final legacy of the Bush presidency in the great sweeping narrative of stock market capitalism which for most people, be they your fellow party members or indymedia readers, really only includes a few isolated examples of crises ; the Great Depression (so great it gets capital letters), the Oil Crises (so terrible it sent most of Ireland to candlelight and insured the British didn't bury their dead for a winter and then saw their last leftwing government killed) but significantly don't cite the South Sea Bubble perhaps it being too far off in the distant memory of a non-regulated market whose speculations extended as far as they did in no small part thanks to the belief that the some companies are "too big to fall". But the contemporary anti-capitalist approach to the sub-prime crises in US and US satelite economy stock markets and bank solvency should properly be approached as a critique of the anglo-saxon model of finance. Instead of lapping up the talk of disaster & recession in the English speaking world you should pay attention to how the Germans, Japanese (with their peculiar negative interest rate background to bail outs), French, Brazilians, Chinese and other heavy weight European economies are reacting. Just for example Jean François Gayraud a colonel in the French equivalent of MI5 who heads up their financial crime division and authored the good book "G9 guide to global mafias" (2005) has this week stepped out of his usual "no comment" box to give half a dozen interviews arguing (on a personal basis not DST) that the sub-prime crises was engineered with true mafia style to blackmail the US government into what is effectively a _nationalisation_ of key financial institutes.

Anticapitalists ought not be surprised that the global financial system is a mafia. We know that. But we ought to express serious and articulated and well-informed interest when the anglo-saxon & US model of finance fails so miserably leading to results which if they were identified properly in the commercial media & our understanding of the "patch cure" would raise irony :- $700 billion blank cheque which you refer to, which obviously is not a blank cheque because we know its value and the conditions attached are being openly put to Congress & Senate - is nationalisation. It is in fact historically as significant a rescue package and corrective influence on free market liberalism as parliament's inquiries, compensations and subsequent confiscations were during the South Sea Bubble in the 1720's. As then when a corrupt and bribing mafia took advantage of contemporary commercial theory as now when a so a unidentified complicty of mafia interests has planned almost to precision a stunt which guarantees the retirement of some of Wall Street's blue chips, huge acquisitions in foreclosure, and the devil's deal on economies which too quickly adopted the US model of rapid growth.

Obviously the Irish celtic tiger figures amongst those economies and thus it is no surprise that it has officially entered recession this week being fundementaly incapable of weathering the damage to the US and UK economies which other EU economies with higher inflation and unemployment and previously slower growth can. That is significant. EU states who chose to invest in social services and education and not enjoy a celtic tiger also reined in their banks and lending and insurance companies.

Lastly it can not go without comment that this global finance "shake-up" or reorganisation seen from the perspective of billionaires or ordinary joe soaps alike, has followed the meddling with food values, inflation of oil and the still open to investigation and understanding of the insider trading suspicions raised during the collapse of Societe Generale earlier this year which was of course attributed to one rogue trader whose naughtiness had not only escaped attention of the banking sharks to stop him but also more significantly and typically _to take advantage of the big fecking hole he was digging in bank stability_. Naturally we remember how the French state which now decries Washington's de facto "nationalisation" entered partnership deals with larger banks to save the day. Exactly the same thing is happening now. WE know capitalism means big fish eat small fish. What we need to know is that capitalism in its truest mafia style also means very big fish eat other very big fish. The fish that's left has tentacles & is not really a fish at all but something 'orrible and mythic in its ugliness. It is in fact the capitalist beast which we complain about so much that when it emerges from the depths we've actually used up the words to identify it.

But news is not all bad for anti-capitalists. Recently a Barcelona based anarchist and proponent of "deceleration" alternative economics quite spectacularly came out and published in a newspaper drop and online his explanation of how he had misappropriated close to 500,000€ in a serial credit sting on financial entities. He gave over 330,000€ of that to social movements in Barcelona and hinterlands & is now resident outside of the state hoping people in similar economic areas will copy this "new anticapitalism" idea which is quite honestly more effecitve than breaking an ATM machine. You can read about that new movement here :- http://www.indymedia.org.uk/en/2008/09/408933.html & here

http://polaris.moviments.net:8000/i-have-robbed-492000-...ciety

With financial giants toppling at rates that shock even seasoned financial commenter, many of us are left wondering, how did this state of affairs come to pass. What is becoming obvious is that the financial markets have become increasingly complex. In this article, Paul Bowman looks the nuts and bolts behind the economic headlines, explaining what is it that is being sold and why nobody seems to be able to stop the chaos from unfolding.

This is the first part of a series of articles investigating the capitalist financial markets from a critical perspective. With such a large topic it is tricky finding a route into the subject and a plan of enquiry. The chosen road is to start with a look at the financial markets, particularly focusing on the mechanics of some of the instruments that have led to a momentous transformation of the workings of global financial markets in the most recent decades.

At first sight, this approach may seem odd, perverse even, like examining the internal workings of a clock as a prelude to discussion the social relations of time. However this "inside-out" approach is justified by the fact that as well as a system of social relations, capitalism is also a system with internal mechanics. Those mechanics evolve in response to the historical development of struggles over exploitation, but what new directions the new mechanics make possible in terms of capitalist strategies, in turn, shape the new struggles of today and tomorrow. The next article in the series will place these market mechanics in their fuller historical context. But for now let's start by investigating the mechanics of capitalist financial markets......

To see the rest of this article below follow the link below:

a small addition to the last comment

The 1929 Wall Street Crash under Hoover's presidency not only had immediate consequences in Europe contributing to sky high inflation and the rise of NAZI-ism, it also led to the "New Deal" of Roosevelt as the American peasantry (for want of a better word) went to famine. The "New Deal" not only saw top down inteference in the market but more significantly grass root upwards changes. It was a peculiarly American solution to a strangely American problem which notably had no strong labour voices left to direct alternatives. But it was not the only solution on the table. Not enough people mark the significance of the fascist coup d'etat plot to overthrow Franklin D Roosevelt in the USA known as the "business plot" exposed by US General Smedley Butler. http://en.wikipedia.org/wiki/Business_Plot It is perhaps worth mentioning because one of the plotters was in fact Prescott Bush, papa to George Herbert Bush and grandpappy to GW Bush. Although he escaped implication in the plot at first historians are now agreed that he played his part and the part irked insiders enough to ensure serious determination to strip his assets by the Roosevelt presidency later on in the 1940's for his business deals with NAZI Germany. Which of course happened. But we are not talking about global economies which work in the same way as 1929. We are not being offered a "New Deal" with guaranteed food vouchers in Walmart and jobs at Mc Donalds by either Mc Cain or Obama. We don't have gold standard. Our stock quotations are carried & traded by computer systems in milliseconds 24 hours a day long before they even get to flicker on the boards or appear on the newswires. We are no talking about a fascist coup d'etat threat to a popularly elected US presidency.

that is all in the past now.

What is saddest is many Irish people fell for it. The short burst of prosperity and arrogance which if not properly dealt with now by serious overhauling of regulation and injections into long term infrastructure which is not reliant on hydrocarbons (logistics moved to rail freight and shipping rather than motorways and cheapo flights) within a short time Ireland will be looking for hand-outs from the EU again. Just when they rejected the european model of wealth creation by saying No! to Lisbon and just after the Europeans realise that Washington's worries are indeed EU opportunities.

odd how it works out no?

By the way though UK readers were interested in Enric's revelation (see link in last comment http://www.indymedia.org.uk/en/2008/09/408933.html ) of the "new Anticapitalism" formula for serial credit stings, their debt management and legal system doesn't favour ordinary joe soaps and anarchists using the scam. But Irish conditions are perfect. Any reader can if they want turn a dole payment into approximately half a million Euros within 2 years. Hopefully they will like Enric return much of the gains to anarchist projects, anti-capitalism, social forum organisation etc., But even if they just spend it on fast cars and coke - sooner or later the state and banks will moved to change the rules. & when they do so the left will be at an advantage. None of us want things to be like 1929. Neither us on the left or those in the kleptocracy mafia circles of global finance. 1929 didn't make money for anyone - indeed it left messes which were only resolved by Barton Woods and the establishment of our present globalisation in the 1940's and suspension of gold standard. & we don't want the food crises of last year to continue. Those Americans who have the gumption can squat. But Yankee woes are not what any globalisation activist should worry about. Nor should people really expect the Yankee model to last forever. Rather to try and pay attention to what com'es next before, you know, das kapital finally ends belly up like a beached kraken.

Yes, it is plain to see the evil at work here, but thank you for the new facts and intelligences. I am dismayed however, and I seek assistance. I feel powerless to do anything about all these bad ongoings. While it would be sweet, I obviously can't blow a bank up in retribution. But what can I do? How can I exercise influence. To me it seems I have none. I whine on the phone to my senators all the time. I send emails and inform people. But the snake is still dining on me and the rest of the poor.

I'm writing lots of free software to help people, like meal planners and doctor's software. But still.

I am not going to support a military overthrow of the country. I seek actionable instructions. But this paranoid facist state will likely be monitoring and analyzing all emails. I know because I worked on the very software. They will destabilize any nascent group and work to turn it towards in-fighting.

We know we are being robbed. Is the only answer to get all angry about it and march around with T-shirts and slogans? That's fine in the city - but the media puts an iron curtain around these activities and the sewer pipes that feed the televisions will show none of it. There are restricted free speech zones now. And if you are a political dissident in the increasingly sinister US of A, then you will be called a terrorist and imprisoned. So, what are the options? Must we resort to secrecy and the like, or can we do this in the open?

I work on technological solutions, like spreading these messages which is a great thing - thank God for indymedia.

What about legal training for us? For the poor. I want to help train people using free software to be lawyers so they can start fighting back... but then they will just invent new laws to remove our rights. O, right, this is indymedia.ie -> Ireland. Shit. You guys know more than anyone what that's like.

The suburbs of America are very restrictive and conformist - do you think we should try to break them? To bring forth more educated political views. How. I'd really like some pointers.

Email me andrewdo@frdcsa.org. encrypt if necessary.

Thank you.

Good work guys.

Save Tara!

Here's another way of looking at the crisis....

First off, a system that charges interest by any amount requires growth for that interest to be paid off. Ever since the arrival of cheap oil in the world economy over the past 6 or 7 decades, this cheap energy has allowed a huge level of growth and was essentially the mechanism that allowed the resources of world to be easily extracted and turned into product (and a little while later dumped in landfill.)

At the same time the banking system has grown hugely along with debt. The ratio of deposits to loans has risen steadily from around 1:10 to figures as high as 1:80. The recent global property boom was the apex of this and whilst clearly much of it was fraudlent because the bankers knew people would not be able to pay back, there was still this sense that growth would go on forever and thus the debt could be serviced.

However we are quite clearly at Peak Oil. In fact peak energy per capita may have arrived sooner back in the late 1980s. The other key thing is that the Energy Return On Investment (EROI) or the amount of energy you need to use to get a unit of energy has been falling. During the glory days of the upside of cheap oil, this may have been around 100 to 1 or 80 to 1. It is not clear where it is now, but it is certainly falling. The further it falls, the more energy you have to expend to get energy. Thus in Saudi you might need to burn 1 barrel of oil to get 40, and this includes refinery and pumping costs. As we move to deeper and smaller reserves and especially for Shale Oil, the EROI is anywhere from 5:1 to 1:1. At 1:1 you are getting nothing back.

But stepping back. At an EROI of 40:1, you need to devote 2.5% back, at 20:1 it rises to 5%, at 10:1, you are now up to 10% and at 5:1 it is 20%. Think about that, as the EROI is falling more and more of the economy is now devoted to expenditure just to pay for the energy to keep it going. And the most optimistic on Shale Oil, suggest it has an EROI of 5:1.

Hundreds of years ago, when basically the only energy was animal power and burning wood, the EROI would have been very low and this would have been one of the factors which limited the rate of growth of the economy and is probably why most of the religions of the world frowned about charging interest because the economy could not grow quick enough to pay it back. That is not to say there wasn't some interest charged, but there certainly were booms and busts and times when all debt was simply cancelled in order to allow the system to start over again.

Today, the scale of debt and energy usage is simply massive. Given the recent prices rises in oil and food, the effects of Peak Oil -currently global production has been on a plateau since 2004 or 2005, and EROI has to be falling, then this has somehow made it presence felt in the global financial system. In other words reality has invaded the financial universe to tell it that there isn't going to be endless growth,, and at best it will be flat and may even fall. Therefore there has been a sudden realization of sorts that all these trillions of debts will not be paid off. Ergo, it's time to cash in and back out. As costs go up everywhere for everything, people have less money to be paying off as interest for various debts. Feeding oneself comes first. The bankers want to be bailed out, but it doesn't actually change anything. It doesn't change the fact that there is less inherent surplus in the system to pay financial parasites who don't actually do anything productive.

The next stage of the game, even if politicians and bankers don't understand or recognise it, is that for the global economy to adopt to the new realities that energy is no longer cheap and resources are really finite, it has to undergo a fundamental structural adjustment. The current architecture of the global capitalist economy is based on the assumption of cheap energy and endless growth. It is now changing before our very eyes.

Note 1: Extraction of resources and their end cost is dependent on how easy it is to extract them. In general the easy to get and high grade ores of everything has already been taken. To get lower grade and sparser ores requires more energy to simply mine and process them. Up to recently this has been hidden. The market did not send us any signals about it. With the era of cheap energy well and truly over, it follows that the era of cheap resources is over. This automatically affects practically everything in the economy.

Note 2: The recent build out of motorways in Ireland has been a complete waste of time, especially the M3. A motorway is designed for around 80,000 cars per day and the planning lifetime expects this for 20 years. There is no way 80,000 cars a day will ever drive in the direction of Cavan every day for the next 20 years. If anything, we have reached Peak Cars in Ireland and the motorways will be within a few short years be seen for what they are. An huge waste of money and a huge waste of prime farmland. -i.e. a mis-allocation and destruction of resources.

See, hear the Ron Paul speeches, read the truth about these Chancers:

http://www.campaignforliberty.com/

''...a Treasury spokeswoman told Forbes.com Tuesday.

"We just wanted to choose a really large number."''

more at

http://lmv.hu/node/3039

Caption: Video Id: QJc7tEqiYB0 Type: Youtube Video

Embedded video Youtube Video

If global corporations have been allowed to unleash their predatory capitalistic power upon the world, it's possible that a global financial meltdown may be necessary to restore all governments to control over their nations so that corporations are not allowed to take all citizens of their nations hostage.

Corporations as a tool of capitalism are very useful; as a controller, they are very poor, and tend to disregard citizenship rights in favor of forward profits. No nation needs to be compromised by its own global companies, or to endanger other nations because it "must" to continue to make money.

The price is too high, and there should be a therapeutic correction in the global dynamic to permit the citizenry to come first in any country, not its corporations. Too much uncontrollable power turned loose from government control harms all countries.

Governments must put citizens first, not companies first.

Some of you may be familiar with Micheal Ruppert who used to run the From The Wilderness website until he had to stop and leave the country due to sabotage and bad health.

He wrote about and investigated many things from Drug wars, to Finance and to Peak Oil.

And back in 2002 up to 2006 he had been issuing economic alerts and predicting what we are seeing now and the fall of the dollar. Recently he has returned to writing and has started a blog and today's entry is quite interesting. Here is an extract as he basically says the whole thing is a ruse. I have highlighted the key points.

...Since 2003 I have told my readers that the destruction of the U.S.economy was planned, essential and a foregone conclusion. It has to do with Peak Oil. There is no economy without energy. The world is running out of oil faster than almost anyone had predicted. Even previously optimistic opponents of Peak Oil have acknowledged that global decline is now between 5.8% and 9% per year. That means that if the world produces 85 million barrels per day this year, it will possibly produce less than 80 Mbpd next year. Demand destruction is conserving a resource for which there is no replacement and this is what has always been intended. An $8 drop in price today has done nothing to reignite demand. The United States, with 5% of the world's population using a quarter of the world's oil, was/is the ONLY point of demand destruction available that will save human industrialized civilization. I have said that consistently for many years. I told you that the real Powers That Be had gotten or would get their money out and safe before they crashed everything. They did... It was your money. It was our money.

What he is saying in the 2nd highlighted part is that since the US uses and wastes the most, then from a global perspective by hitting the biggest wasters, the rest of the world gets some breathing space and indeed it makes sense.

On the first point, he should have given some references, but antidotental evidence suggests this is entirely possible and ironically it is technology that may have caused it, because it is technnology that allows you to extract oil faster and maintain the high flow rates from oil fields, resulting in a big drop when the decline begins to hit. Also if the economy goes down the swany, there will be less capital available to finance the costly projects needed to extract the much more expensive and difficult second half of the oil remaining and so it may never been extracted, thereby meaning there is less to go around.

Overall then, Ruppert is suggesting the really big players knew about this and used their fraudulent methods to dump money and swap it for real assets which presumably they have bought elsewhere.

His old website is still online at: http://www.fromthewilderness.com

The Catholic Worker movement has its origins in the Great Depression

of the 1930's. The original community with houses of hosptality for homeless men (East 1st. St.)

and women (East 3rd. is still located in spitting distance of Wall St. As popular totalitarian repsonses of

right and left competed in response to the Depression Catholic philosopher Peter Maurin and IWW convert

Dorothy Day suggested the rich should share their excess and proposed a gentle pesonalism.

In repsonse to the growing desitute that Catholics should rediscover the gospel mandate

of practising the acts of mercy, that every Catholic home should have a Christ room for the stranger

and every parish a hospitality house for the homeless.

They proposed the means of production should be recaptured

by the workers and farmers. They suggested that humanity is not doomed to war and exploitation in order to feed,

clothe and shelter itself. They proposed that workers should become scholars and that scholars should become workers.

This recent article reflects on one of the oldest anarchist traditions in North America. It might be helpful

as we enter a period where a generation that has been raised on credit in the Celtic Tiger hits the wall -

without the survival skills that people still had in the '30's and letalone the hippy '60's and punk '70's.

Fueling the Fire of Real Change

By Chris Hedges

Turn your back on Wall Street. Walk a few blocks up from the gleaming

and soulless towers of disintegrating capitalism to the shabby, brick

Catholic Worker house at 55 E. Third St. Sit, as I did recently, in

one of the chairs in the basement dining room with its cracked

linoleum and steel utility tables.

"Works of mercy and contact with the destitute sustain the spark in

the ashes," William Griffin, who has been with the Catholic Worker for

34 years and writes for the newspaper, told me. "It is with the poor

and the indigent that you sense the imbalance and injustice. It is

this imbalance that inspires action. Generations come in waves. One

generation is inspired by these sparks, as Martin Luther King was

during the civil rights movement. These fires often fall away and

smolder until another generation."

The coals of radical social change smolder here among the poor, the

homeless and the destitute. As the numbers of disenfranchised

dramatically increase, our hope, our only hope, is to connect

intimately with the daily injustices visited upon them. Out of this

contact we can resurrect, from the ground up, a social ethic, a new

movement. Hand out bowls of soup. Coax the homeless into a shower.

Make sure those who are mentally ill, cruelly cast out on city

sidewalks, take their medications. Put your muscle behind organizing

service workers. Go back into America's resegregated schools. Protest.

Live simply. It is in the tangible, mundane and difficult work of

forming groups and communities to care for others and defy authority

that we will kindle the outrage and the moral vision to fight back. It

is not Treasury Secretary Henry Paulson who will save us. It is

Dorothy Day.

Article continued......

http://www.truthdig.com/report/item/20080928_fueling_th...ange/

“Only a crisis, actual or perceived, produces real change. And when the crisis occurs, the change depends on the ideas that are lying around." And then he goes on to say, “That, I believe, is our basic function: to keep the ideas ready until the politically impossible becomes politically inevitable.”

Milton Friedman

award-winning journalist, syndicated columnist, author of the bestselling book The Shock Doctrine: The Rise of Disaster Capitalism, Naomi Klein, gives a fine overview on Democracy Now!

http://www.naomiklein.org/shock-doctrine

http://www.youtube.com/watch?v=kieyjfZDUIc

Naomi Klein: “Now Is the Time to Resist Wall Street’s Shock Doctrine”

http://www.democracynow.org/2008/9/24/naomi_klein_now_i..._time

Here are some of the important parts, read it, watch it, listen to it....

Scary times indeed

Caption: Video Id: kieyjfZDUIc Type: Youtube Video

Embedded video Youtube Video

Part 3 of recent mega popular online film Zeitgeist gives a strong critique as to the origins of these banking, and related, shocks. The film is controversial and might not have got it all right, but it points out a lot of things to think about

http://en.wikipedia.org/wiki/Zeitgeist,_the_Movie

view part 3 of film

http://video.google.es/videosearch?q=zeitgeistmovie+part+3#

To stop your IP being automatically logged by the provider of the (Google video) video content, we have not loaded it automatically. If you wish to proceed to watch the video, then please Click here to load the embedded video player for video Id zeitgeistmovie+part+

This setting can be controlled by your User Preference settings.

Am I right in thinking this represents approximately 100,000 Euros for every man, woman and child in the Republic of Ireland?

How could such staggeringly large losses have ever occurred at the hands of the few dozen (or less?) senior bankers responsible? Where have the vast sums of money in question disappeared to? Why is it that those responsible for the losses are not being investigated by anybody (as far as I know)?

Where will the 400 billion Euros bailout money come from?

How is the 400 billion Euros bailout money to be paid back?

If compound interest applies, as I'm inclined to assume will be the case, what will the total repayment figure be?

Is there a risk that the whole nation will now become swamped in a growing bog of debt that it can never (in practice) get out of? -- which, in effect, now gives the "Money Masters" pretty much full control over us all (more or less)?

What a mess?

class war in america

karl would be proud

"Ireland's decision to guarantee all bank deposits will contribute to the demise of the single European currency, because it will erode the euro's credibility if it's allowed to go ahead, Hugh Hendry, chief investment officer and Partner at Eclectica Fund, told CNBC on Thursday."

"The plan pledges to guarantee the liabilities of six Irish-owned banks totalling some 400 billion euros ($565 billion), more than twice the country's annual gross domestic product."

"If I was German, I would say give me back my Deutschmarks," he added.

The above three excerpts have been copied from CNBC article at http://www.cnbc.com/id/26986243

Sarkozy's vain attempt to persuade the other big countries to back an EU 300 trillion banking bailout, and the unilateral emergency legislation by the UK, Ireland and others shows that even as an economic project the EU lacks basic solidarity. Why then continue the useless attempt to create an EU patriotic 'identity' and a revisionist history that 'binds' the EU states together while excluding America's gallant ally of WW2, the Soviet Union and the current Russian Federation that remains?

In an article from the www.wsws.org website titled: US congressman: “If we don’t pass this bill, we’re going to have martial law in the United States” they are reporting that the above quote came from one of the congressmen during the session on the vote for the US banking bailout.

Traditionally such views have been kept to the sidelines and rarely given much voice, but it is clearly a real concern and threat.

Here is what the article says in the report:

In the wake of Monday’s vote in the US House of Representatives rejecting the $700 billion bailout package for the American financial industry, prominent voices in the US and international media have responded by denouncing the lower house of Congress and complaining that the American political system is too susceptible to popular opinion and insufficiently obedient to the will of the corporate and political elite.

The yearning for more authoritarian forms of rule was expressed by, among others, Michael Gerson, the former chief speechwriter for George W. Bush. In a column in the Washington Post, he complained, “[I]t is now clear that American political elites have lost the ability to quickly respond to a national challenge by imposing their collective will.” The Times of London, part of Rupert Murdoch’s media empire, was even more blunt, headlining a column, “Congress is the Best Advert for Dictatorship.”

And further on the actual quote from Congressman Sherman:

...The next day, the Los Angeles Times, in an article on the Senate passage of the bailout measure, noted in passing a statement by Democratic Rep. Brad Sherman from the San Fernando Valley in Southern California which underscores the authoritarian atmosphere surrounding the proceedings in Congress.

Sherman, who voted against the bailout bill on Monday, said, “The one thing that’s been proven is the absolute fear-mongering that’s being used to drive us is false.” He continued, “I’ve seen members turn to each other and say if we don’t pass this bill, we’re going to have martial law in the United States.”

While I must start by saying I share comrade Allen's general point that the ultimate solution to escaping the crises that capitalism keeps plunging us into lies in escaping from the relations of capitalism itself, I feel that his article on the current conjuncture has failings which should be addressed.

Starting with some factual points:

The figure of $1.8 tr daily for currency trades is amazingly out of date. The figures for average daily trades on the Foreign Exchange market are freely available from the BIS (Bank of International Settlements) at: http://www.bis.org/publ/rpfxf07t.pdf. For the record the figure are, as of last year, $3.2 tr daily on the spot market and a further $2.2 tr in OTC Forex derivatives and $6.2 tr exchange traded derivatives.

While it is technically true that swap derivatives can be structured as two consecutive forwards, the statement "Hedge Funds and Derivatives: These are really an extension of the futures market. Hedge funds purport to take the risk out of the market by buying and selling 'derivatives'" is totally misleading. There is a world of difference between futures (which have been around for centuries) and the recent rise of the credit default swap. Secondly, Hedge Funds may well play with derivatives, but they were created long before most modern derivatives were invented, back in 1940, when Mutual Funds were regulated (for e.g. banned from short selling). Hedge fund were created soon after to evade the new Mutual Funds regulations to allow long/short equity positioning strategies which still make up the bread and butter of their work.

The two axioms that Allen bases his analysis on are Luxemburg's (and not Marx's as he claims) "underconsumptionist" analysis and the good old falling rate of profit theory. As for the first, there is not the room here to go into a full deconstruction of Luxemburg's theory - Suffice it to say, that it has been done perfectly adequately before, see Anthony Brewer's "Marxist Theories of Imperialism" for e.g.

Then we look at the ever-contentious issue of the "Tendency for the Rate of Profit to Fall" (or the TRPF) as Wikipedia neatly abbreviates it. Specifically: "Different studies have come up with somewhat varying estimates but two French writers, Duménil and Lévy state that "the profit rate in 1997" was "still only half of its value of 1948, and between 60 and 75 percent of its average value for the decade 1956-65"."

And further down

"Since 2001, the global system entered a new period of growth but it has been the lowest of any comparable interval since the 1940s. One of the main reasons is that the capitalists do not invest in new plant or equipment or in the creation of new jobs. The capital injected into plant and equipment is only one third of the post war average for the equivalent period in the business cycle while the number of jobs is two thirds below the average."

Firstly Duménil and Lévy appear to substitute "the major capitalist economies" for the global picture and then further substitute the USA as prime exemplar for the major capitalist economies, as all their actual work is based on looking at US economic data (see their biblio at http://www.jourdan.ens.fr/levy/biblioa.htm.) and occasionally their native France. This is absurdly Western or OECD-centric.

Along the same line we get to:

"Since 2001, the global system entered a new period of growth but it has been the lowest of any comparable interval since the 1940s. One of the main reasons is that the capitalists do not invest in new plant or equipment or in the creation of new jobs."

This is in the period where we have seen the largest migration of people from peasant agriculture to urban proletarian production in human history in China. The result is that the global proletariat has swollen from 1.5 billion to 3 billion making us (urban proletariat), finally, the majority of global humanity ever. Now I can't say what measure or definition of growth Allen is referring to, but for any serious materialist this historically unprecedented extension of the capital/wage relation and industrial production just doesn't fit with the above statement.

Moving away from questions of facts to general interpretation, I find the above article to be written at a level of abstraction that conceals what it's frame of reference is. Is it the individual nation state that conventional macro-economics refers to, or is it capitalism as a global world system? Given that Allen's piece makes no effort to situate the current conjuncture in a global context and only makes reference to the actions of the US and local government actions, one is lead to believe the framework in question is the former.

In general the dismissal of the entirety of the recent evolution and growth of financial capital as being explained merely by speculation and greed (with a nod to the old TRPF as noted) is a cop-out. The message is that nothing significant has changed in capitalism's functioning since the days of Lenin and Luxemburg, the gates of Marxist ijtihad are closed. All that remains is taqlid - to build the party in Lenin's model and win power. Yet the grand irony of this position is, and I say this as someone who's not a fan of Lenin, that it is the complete opposite of what he did. He took the new theories of Monopoly capitalism as outlined by Hobson, Hilferding and Bukharin, and then based his strategies on these interpretations of the most recent evolutions of the capitalist world order. When it comes to paying attention to the contemporary developments of global capitalism and their strategic implications, it would seem the SWP could do with taking a leaf out of Lenin's book.

A link to information on the Glass-Steagall Act mentioned in the video from collateralnews: http://en.wikipedia.org/wiki/Glass-Steagall_Act

and a pro-McCain video talking about the sub-prime/financial crisis.

Caption: Video Id: F0Dy1jAXnIw Type: Youtube Video

Embedded video Youtube Video

Again, quality stuff from Democracy Now!

http://www.democracynow.org/2008/10/6/naomi_klein

economic news

We need a banking system. But do we need a banking system like this one?

NEWS QUIZ:

$73.7 million and $57.2 million are, respectively,

A ) the 2007 budgets of the states of Maryland and Mississippi.

B ) the cost of feeding all refugees in Darfur last year.

C ) last year’s pay packages for the Chairmen of Goldman Sachs and J.P. Morgan Chase.

Hint: they both did a heckuva job. (from ironictimes.com)

It's clear we need to have the ability to borrow money, and those who lend it can expect some interest, both to give them a reward and as a cover against defaulters. It's been going on a long time and is not likely to stop anytime soon.

But the excesses of an international money market which can effectively hold the whole world to ransom are not what any sane society needs. The lack of public support for the various "bailouts" and "rescue packages" shows that the politicians are out on a limb.

When there are problems in the Health Service, no ministers stay up all night. When homeless people die of cold, no politician gets woken up by a phone call. But the bankers can get emergency treatment. The public can see this and the public are angry about it.

Politicians who underestimate this anger should tread carefully. People need to be seen to pay for the excesses of the recent past. If the big bankers don't get fired by the politicians, it may well be the public doing the firing at the next election.

In my last comment up the page I mentioned how most of the regulation which FD Roosevelt used to correct the problems of the Great Depression were abandoned by both US Republicans and Democrats and UK Conservatives and New Labour to naturally be accepted as a template by Ireland's FF during its heyday enjoying the PD philosophy. Pierce has followed up on the pivotal Glass Steagall Act - but there are other very important considerations when we consider the collapse of equities and derivatives and what those who made so much "paper or electronic" money in the last two decades expect. We are now seeing a shift in the geopolitical order which was well explained in the Financial Times yesterday by their columnist Philip Stephens http://www.ft.com/cms/s/0/0ed4a750-961e-11dd-9dce-00007...eck=1

& naturally as we move on from talk of 700 billion dollars or shadow nationalisations (by which states such as Ireland or Greece really are hedging to the point of lunatic gambling and posturing) there is one question, allbeit hypothetical, which should be considered and asked and moreover argued by all those interested in current affairs and leftwing solution at both Irish local or global level :-

Wouldn't it have been better for business and finance and so on so forth to simply invest 700 billion dollars in housing the poor of the USA? or guaranteeing the banks of Ireland to house through social building programs those who needed affordable housing here, or disuade the real estate bubbles of Europe?

Of course like nationalisation and inteference in the free market and all types of regulation, such long term thinking would have gone against the grain of capitalism..,

Titled "Money As Debt" the 47 minute video at http://video.google.com/videoplay?docid=-90504743625834...en-CA sets out to explain the basics of what must be the greatest and most outrageous piece of fraud in human history?